A lot of money has been made through real estate in Niagara over the past year. Just by owning it! Of course this was the case back in the early days of 2015, 2016 and early 2017 when prices were soaring and every month seemed to set new records. But when the adjustment came in the spring of 2017 with the foreign buyers spec tax and the stress test for conventional mortgages, a lot of people felt that the run of price increases was over. And it was for a while. In fact prices dropped over the second half of 2017 in pretty well every municipality through Niagara. But that slide was short lived.

The demand was just too great and prices were just too low in relation to the GTA for prices to stay down. Beginning in 2018 and continuing into our latest sales reports in October, 2019, resale home prices have been steadily and consistently on the increase. In fact, as we’ll see in a minute overall in Niagara the average resale home price year-over-year is up about 12.31% ($475,935 in October, 2019 vs. $423,773 in October, 2018). And when you consider mortgage rates are around 3%, that spread creates a very healthy return for investors who leverage their purchase.

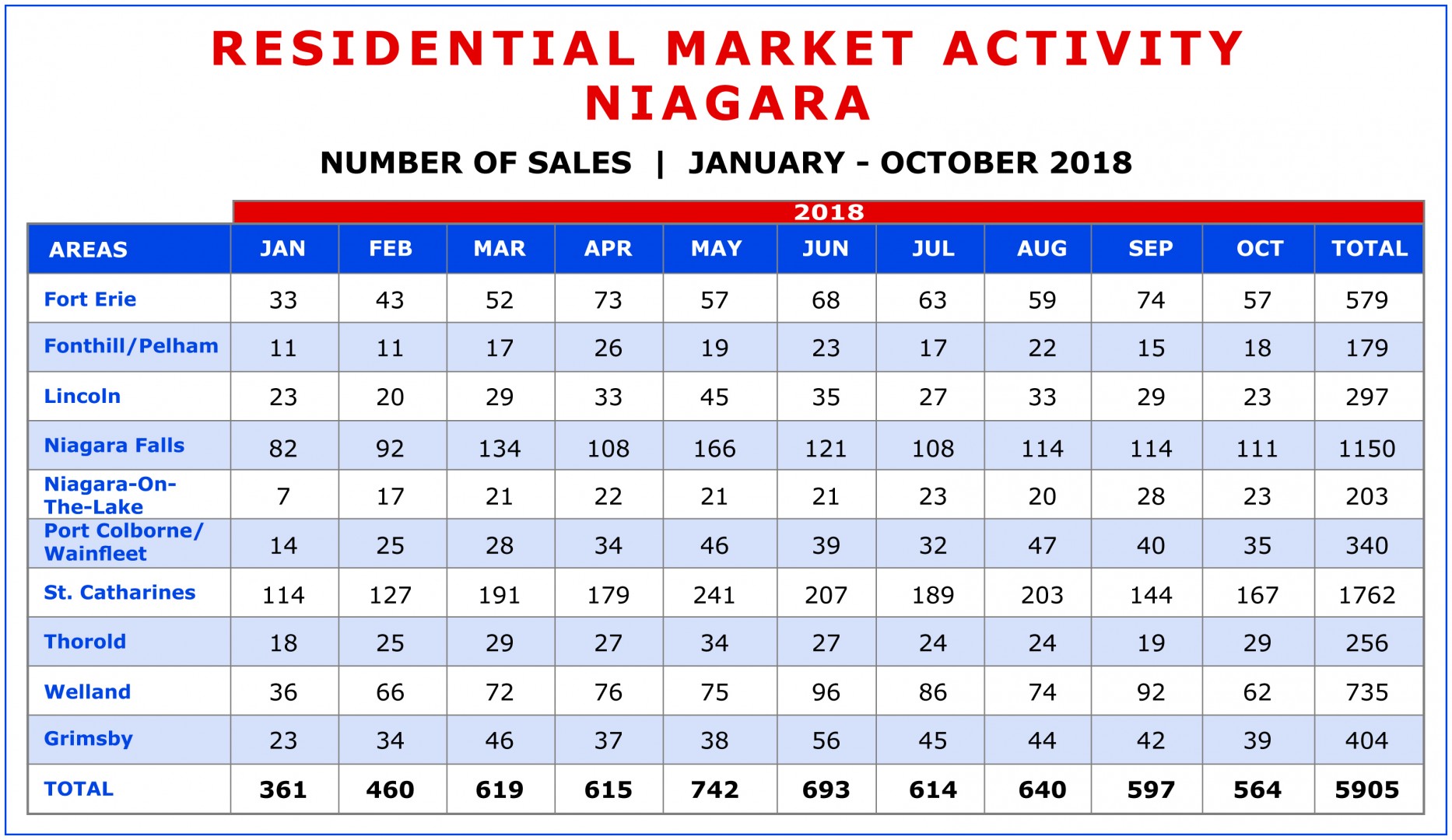

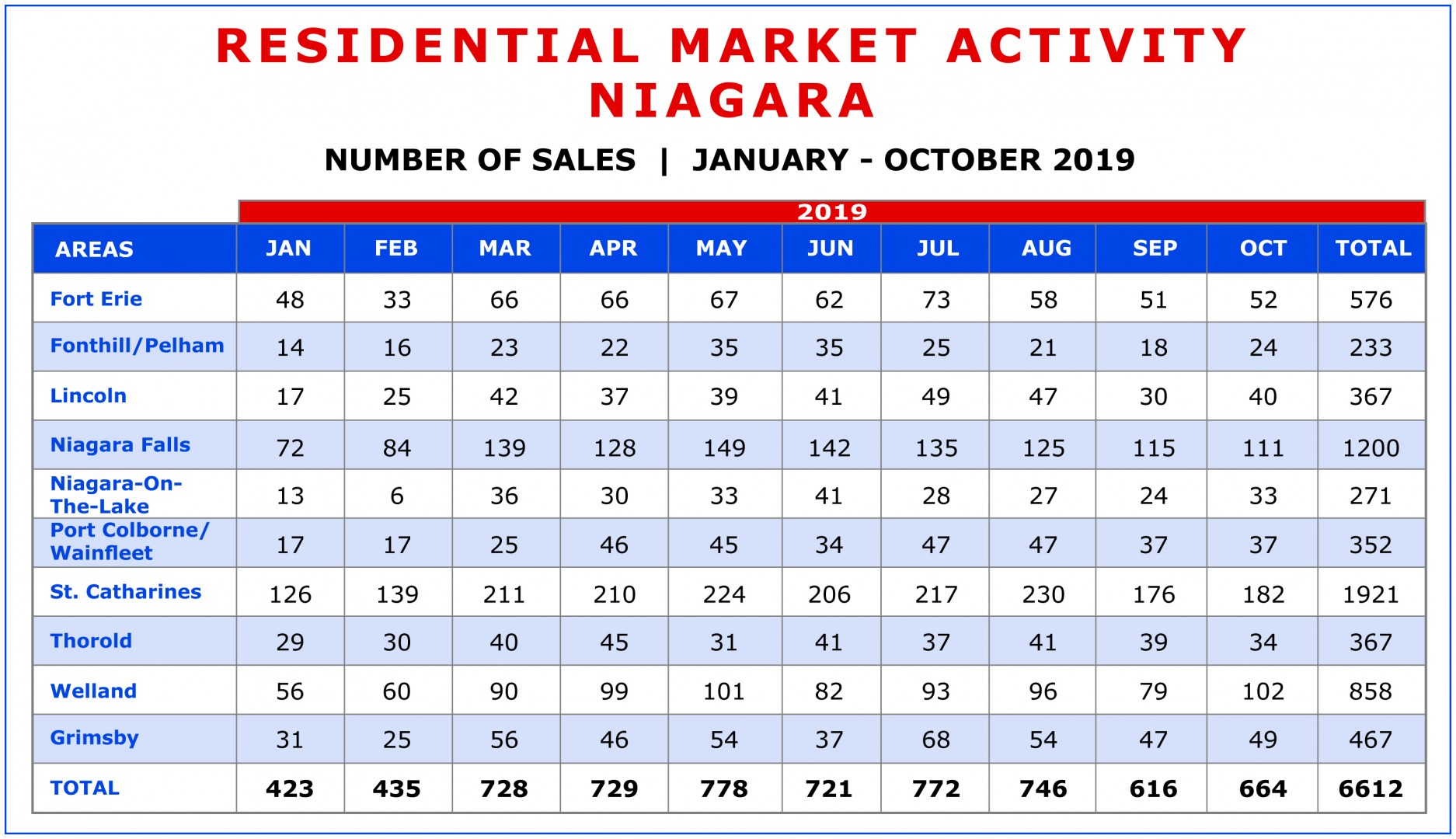

The other interesting thing is that the volume of sales is also on the increase. While still not at the frenzied pace of 2016 and early 2017, overall in Niagara we saw 6,612 units sold in the first 10 months of 2019 compared to 5,905 for the same period in 2018. That’s an 11.97% increase in sales activity year-over-year.

Let’s have a look at the price changes month-over-month since the start of 2019 for each of the municipalities tracked in Niagara.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

You’ll see there are variations from one month to the next and from one municipality to the next. Sometimes the prices hold or even drop from one month to the next. This is especially true in smaller municipalities where fewer sales are registered and one or two large sales can skew the average. But notice the overall Regional average. There have been monthly drops to be sure, but overall the trend continues steadily upward from $416,645 in January to $475,935 in October.

So what can we expect in the days and months ahead? More of the same I suspect. Why do I say that? Because Niagara is still underpriced. Because Niagara over the past couple of years has lead the pack when it comes to price increases. Because Niagara has become the go-to place for Toronto investors and retirees. And because sales volumes are on the increase, which contributes to scarcity and fuels demand.

Look at the sales totals over the past 2 years region by region.

*Sales data provided by the Niagara Association of Realtors and the Hamilton-Burlington Realtors Association as submitted through Brokerage Members inputted MLS sales.

Pretty consistently across the Region we see sales volumes are up year-over-year. The market is definitely gaining momentum. And generally with increased activity comes increases in price. A lot of wealth has been realized just by owning property in 2019. I expect the same will be true moving forward.